Today's topic concerns something I'm asked quite often. When speaking to people who are working at a hospital and are thinking about getting into contracting, I'm commonly asked, “How do you price yourself in terms of the hourly rate you should be earning?”

I'm not sure if I can tell anyone what he or she “should” be earning, but I can give everyone a way to get to a starting point to make a good financial decision.

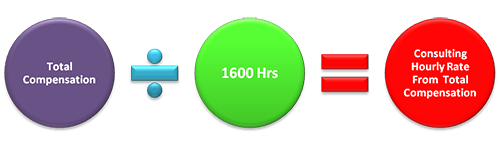

As a contractor, you’re paid on an hourly basis. So, the first thing you want to do is calculate your total compensation on an hourly basis.

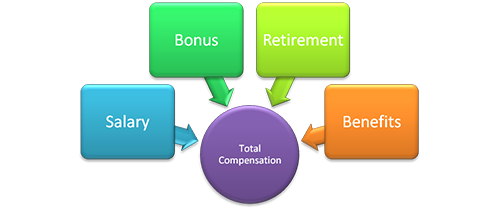

To do this, first figure out your current position’s total compensation. This includes your salary, bonuses, and any retirement contribution your current employer makes. If the organization offering a contract does not offer benefits, then you also need to calculate the total cost of purchasing benefits on your own. This could include medical, dental, vision, disability, etc.

Again, you’re not calculating what you pay for these benefits at your current job; you’re calculating what you would pay to get them on your own. Now, take your total compensation and cost of purchasing benefits to get total replacement income. In order to convert this to an hourly rate, divide the number by 2,080 hours (40 hours/week x 52 weeks/year).

As a contractor, you’re going to get paid only for the hours you actually work. You will not get paid for holidays, time off, or the time you don’t work in between contracts. You don’t have to be concerned about this if you understand the numbers and price yourself correctly.

If you’re working in an area where you’re offering true expertise, you should be very safe estimating that you’ll be working 42 weeks a year (thus estimating that you will have ten weeks during which you’ll receive $0 compensation). So, 42 weeks x 40 hours a week = 1,680 hours. Divide your replacement total income by 1,680 hours and you’ll have the hourly rate that, if you worked only 42 weeks a year, would equally replace the total income and benefits you’ve been receiving at your currently employer.

So, there are three ways to accept a contract and make sure you increase your compensation.

- Work 40 hours/week for 42 weeks a year with a higher hourly rate than the one you just calculated.

- Get the hourly rate you just calculated while working 40 hours/week for more than 42 weeks a year.

- Get the hourly rate you just calculated while working only 42 weeks a year but working more than 40 hours a week.

However, if two or all three of the variables above increase from what we’ve calculated, then you will find, in most cases, your income will increase by 25% to 40%.

You may also like: How Your Limitations Determine Your Salary

Comments